Managing equity is no longer just about tracking shares—it’s about ensuring transparency, governance, security, and integration. Odoo19’s Equity Module expands beyond cap tables and transactions, introducing fully diluted ownership analysis, governance records, multi-company equity management, advanced security, and deep Odoo ecosystem integration. Together, these features give companies and investors a 360° view of ownership while simplifying compliance and scaling across multiple entities.

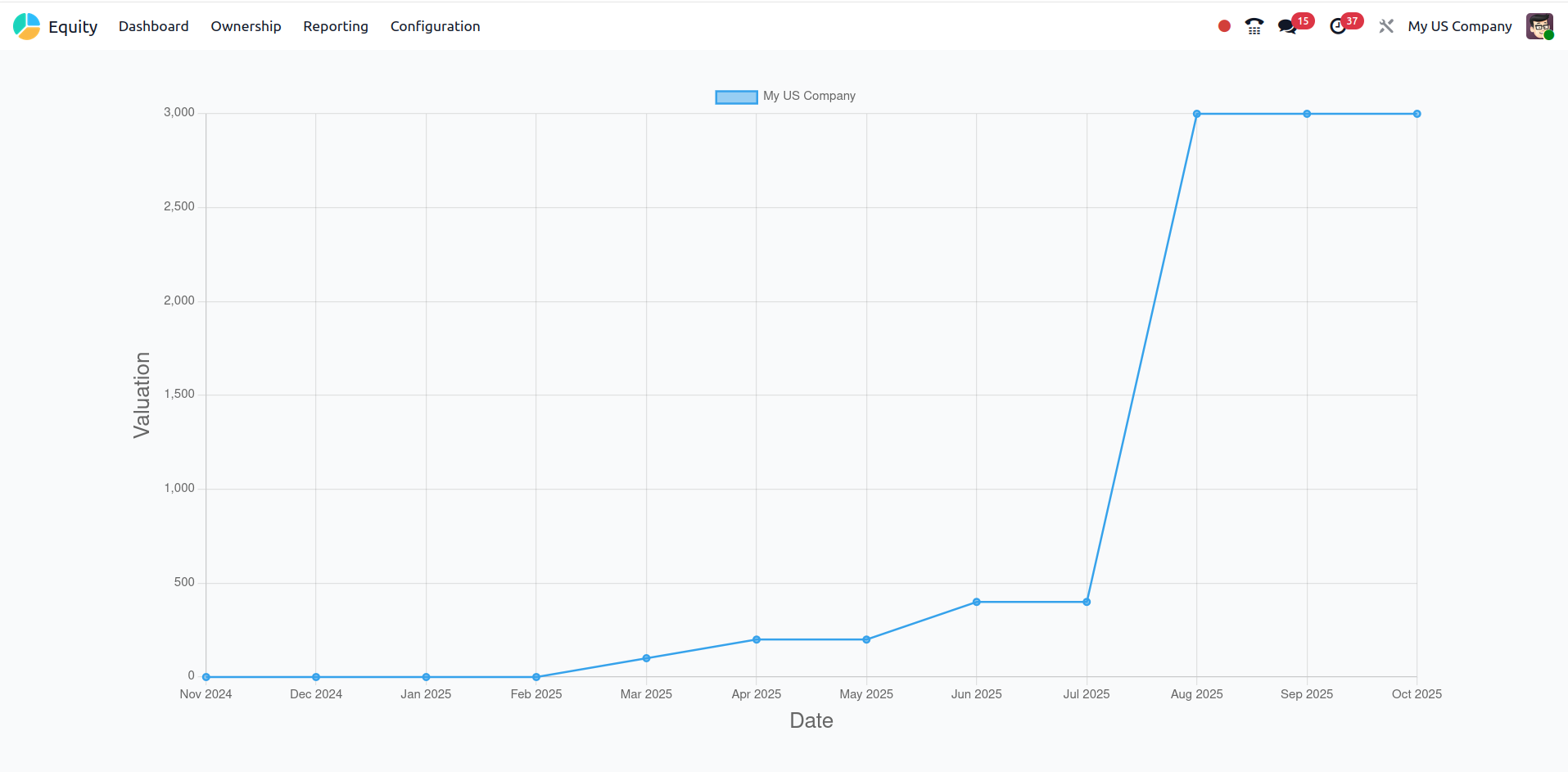

📉 1. Calculation of Fully Diluted Ownership

Feature : Automated Dilution Analysis

Equity negotiations often revolve around the concept of fully diluted ownership—a realistic picture of how much a shareholder owns if all options, warrants, and convertible instruments are exercised. Odoo19 automates this calculation, eliminating hours of manual spreadsheet work and reducing errors. This ensures clear, investor-ready ownership data.

Example:

A startup negotiating Series A funding can show investors not just current ownership but also the future impact of 100,000 stock options issued to employees.

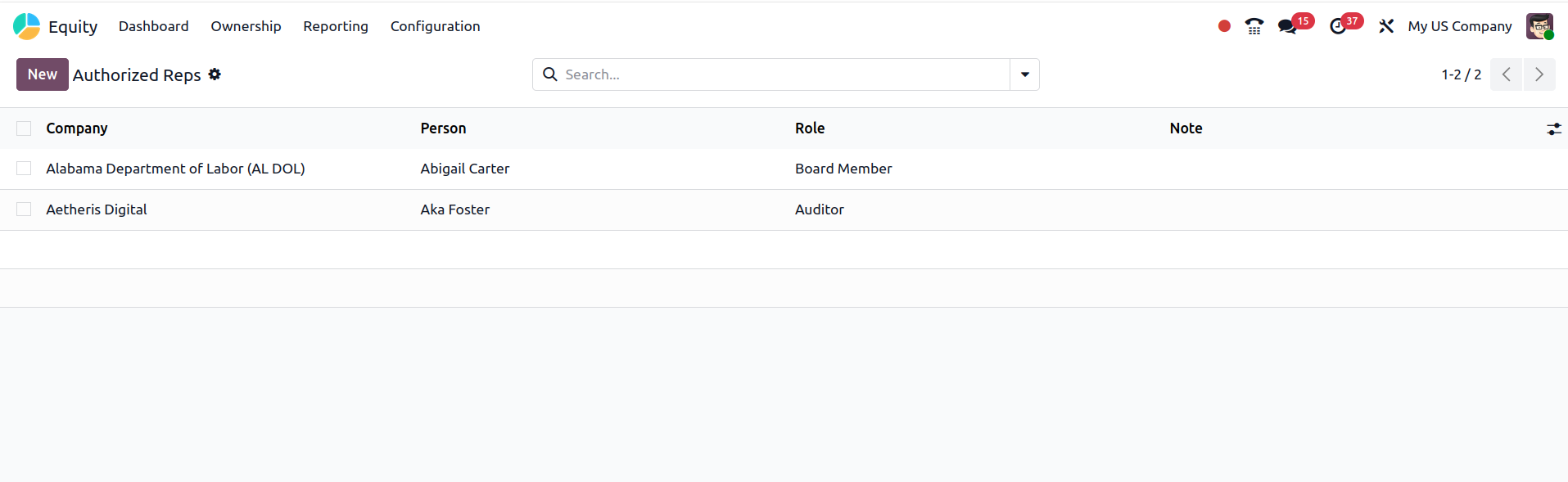

🧑⚖️ 2. Management of Authorized Representatives

Feature : Record of Governance Roles

Odoo19 makes governance transparent by maintaining an up-to-date record of board members, auditors, and signatories. These representatives are directly linked to equity records, ensuring compliance and accountability. Instead of tracking governance in separate legal docs, everything is consolidated within Odoo.

Example:

When auditors request proof of who approved a share issuance, managers can pull up the governance record instantly from Odoo instead of sifting through emails.

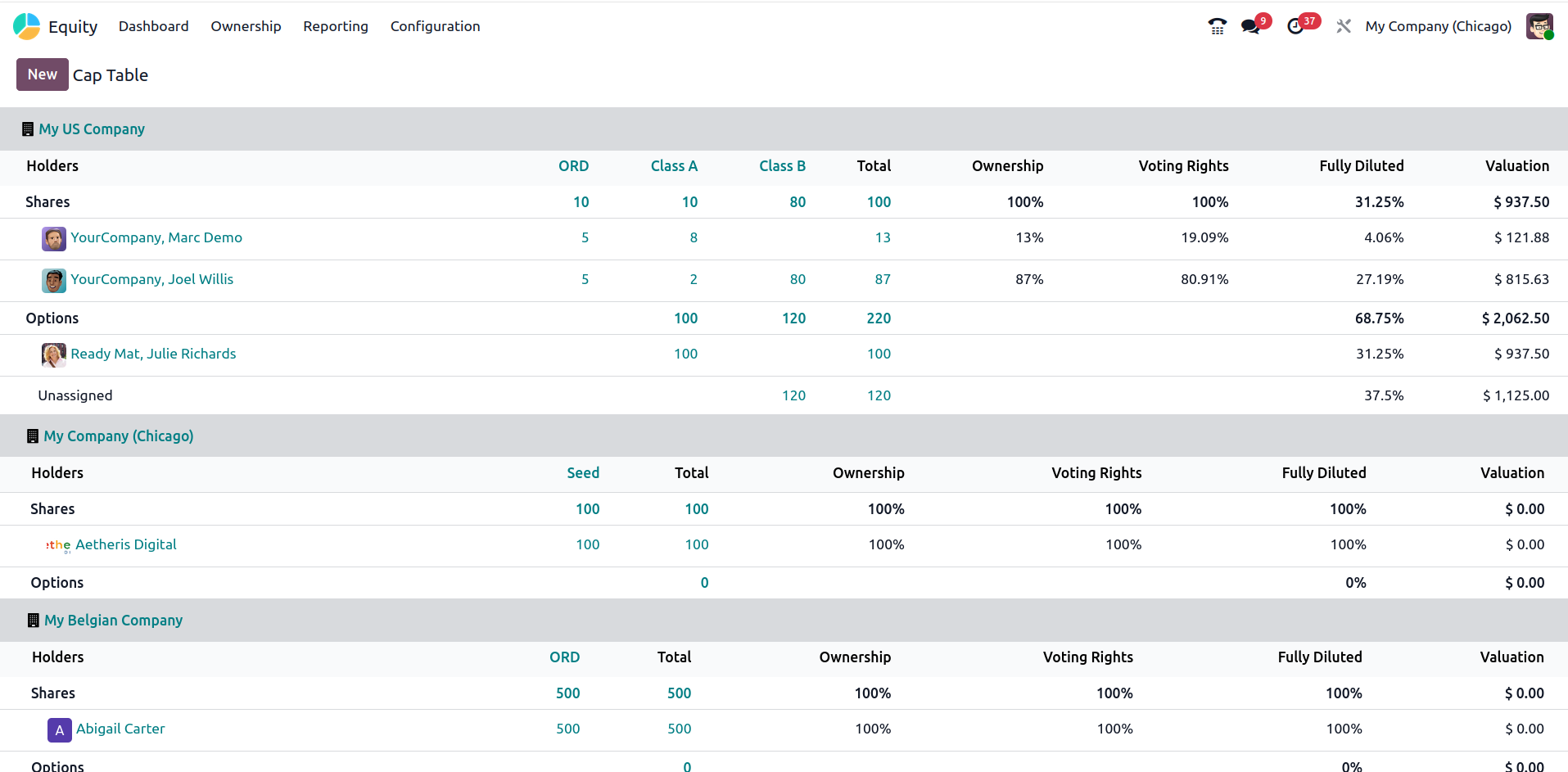

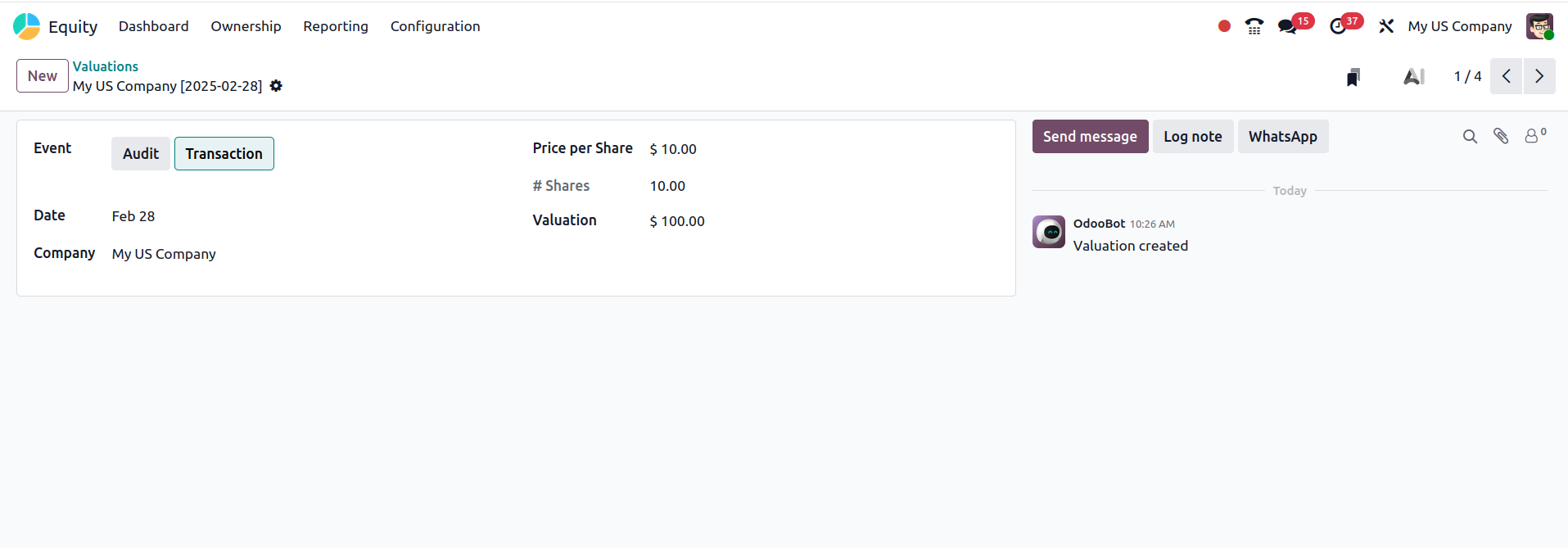

🏢 3. Multi-Company Equity Management

Feature : Scalable Equity for Groups

For holding companies and business groups, Odoo19 supports multi-company equity management. Each entity has its own cap table, while group-level insights allow consolidated visibility. Switching between companies is seamless, ensuring both independence and centralized control.

Example:

A conglomerate with subsidiaries in India, the US, and Europe can manage each cap table separately while still consolidating ownership for group-level reporting.

🔐 4. Integrated Security and Access Control

Feature : Protecting Sensitive Equity Data

Equity data is among the most sensitive business information. Odoo19 introduces granular role-based access control, ensuring that only authorized users can view, edit, or create records. This reduces data leaks and enhances compliance with governance requirements.

Example:

A CFO may have full access to create and edit transactions, while auditors only get read-only access, ensuring independence and security.

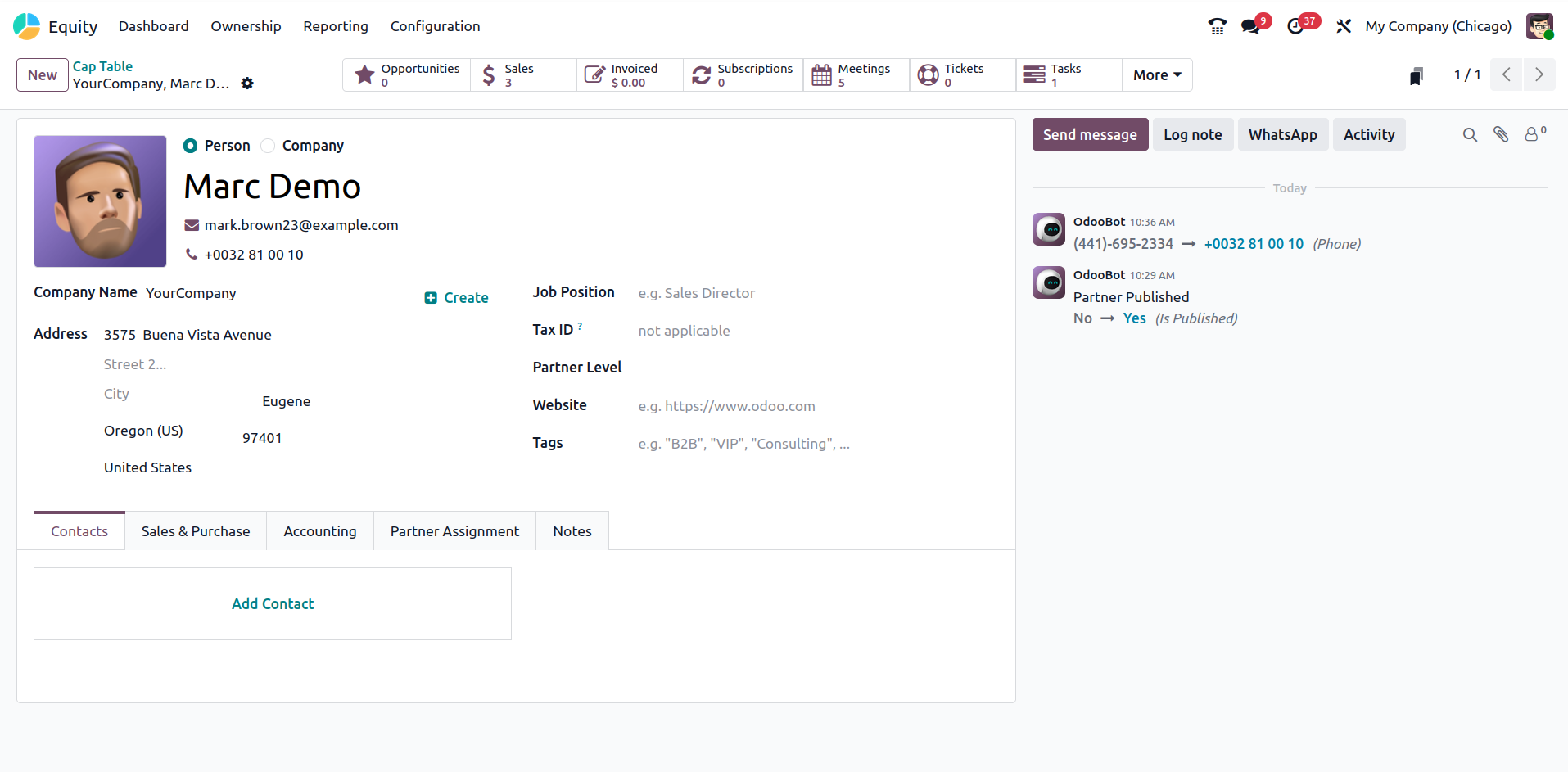

🔗 5. Seamless Integration with Odoo Ecosystem

Feature: Unified Business Management

Unlike standalone cap table software, Odoo’s Equity Module is natively integrated into the Odoo ecosystem. It pulls shareholder data directly from Contacts, links equity transactions with Accounting, and stores supporting legal documents in Documents. This unified approach eliminates silos and creates a single source of truth.

Example:

When a new shareholder invests, their details flow from Contacts → Equity → Accounting, without redundant data entry.

🎯 Conclusion

Odoo19’s Equity Management moves beyond basic share tracking to deliver a secure, transparent, and scalable equity solution. By automating dilution analysis, recording governance, enabling multi-company structures, enforcing access control, and integrating with core Odoo apps, it ensures companies are always investor-ready and compliant. For startups, SMEs, and large enterprises alike, these features turn equity management from a compliance headache into a strategic asset.