Beyond reconciliation and auditing, Odoo19 introduces several general accounting enhancements that improve reporting, tax management, and compliance across different countries. These updates make financial processes more accurate, transparent, and globally compliant.

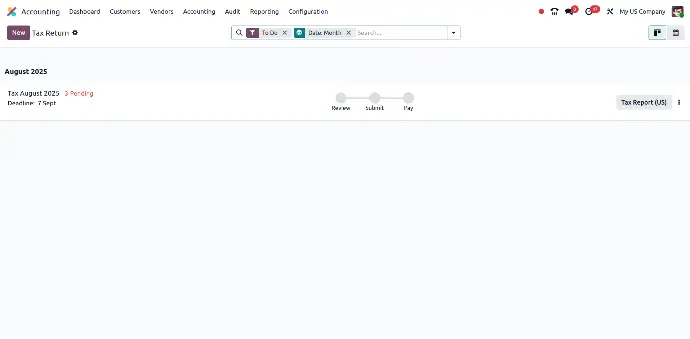

📊 1. Enhanced Tax Return Report View

Functionality:

- Redesigned tax return report with better visuals and filters.

- Helps accountants review tax liabilities in real-time.

Example:

An Indian company can now quickly validate GST return entries with improved grouping and clarity.

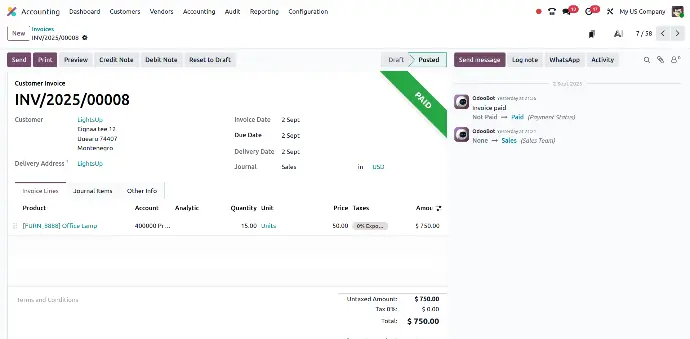

🧾 2. Customer Invoice Debit Note

Functionality:

- Directly issue debit notes on customer invoices.

- Useful for correcting under-billed amounts or adding charges.

Example:

If a client was billed $5,000 but an additional $500 was missed, a debit note can be issued without editing the original invoice.

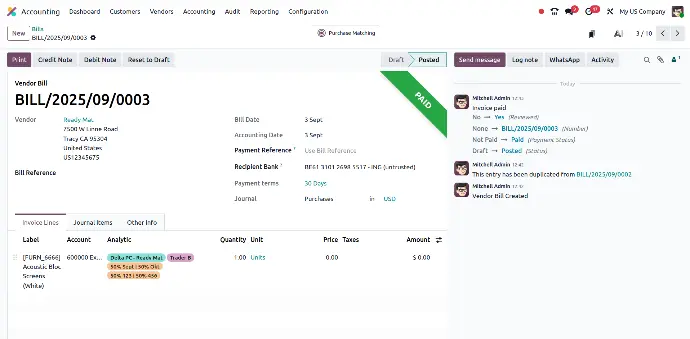

🧾 3. Vendor Bill Debit Note

Functionality:

- Odoo 19 now allows companies to issue debit notes against vendor bills to correct overcharges or errors.

- Instead of manual journal adjustments, debit notes reduce the payable amount while keeping records clear and audit-ready.

Example:

If a supplier invoices ₹1,05,000 instead of ₹1,00,000, a debit note of ₹5,000 can be created directly against the bill. It links to the analytic account or cost center, ensuring both vendor payables and project costing remain accurate.

Why It Matters:

- Quick correction of supplier overcharges.

- Automatically integrates with analytic accounting.

- Improves accuracy in cost center and financial reporting.

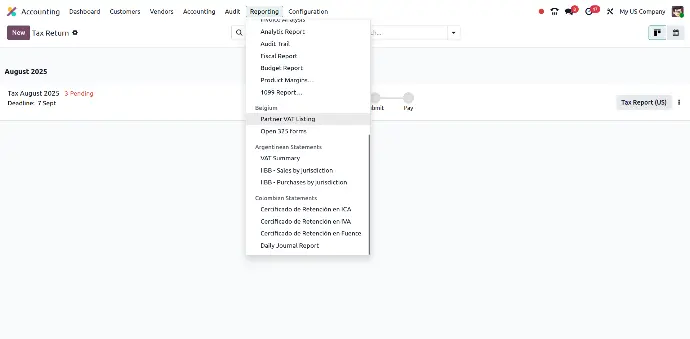

🌍 4. Country-Wise Tax Reports

Functionality:

- Generate localized tax reports depending on the country.

- Aligns with regional tax laws and reporting formats.

Example:

A company operating in India, the US, and France can generate GST, IRS, and VAT-compliant reports separately.

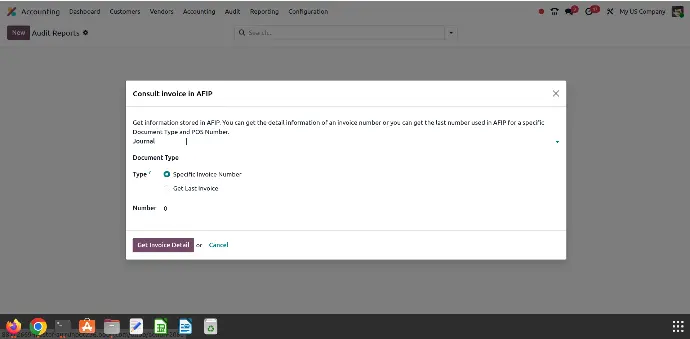

📑 5. AFIP Reports (Argentina Localization)

Functionality:

- New report for businesses operating in Argentina.

- AFIP compliance built directly into Odoo19.

Example:

An Argentinian company can submit AFIP-compliant reports directly from Odoo without external tools.

✅ Conclusion

The general accounting changes in Odoo19 make the platform more robust, localized, and user-friendly for global businesses. From debit notes to improved tax return reports and country-wise compliance, Odoo ensures businesses stay compliant across jurisdictions.

✔ Simplified debit note handling for customers & vendors

✔ Better tax visibility with redesigned reports

✔ Country-specific compliance support

✔ Localized reporting like AFIP for Argentina

With these upgrades, Odoo19 cements itself as a global accounting solution for businesses of all sizes.

Read more: Streamline Your Accounting Operations with Powerful Xero Odoo Connector